Introduction: Why Mold Texturing Matters in Modern Manufacturing

Mold texturing has evolved from being merely an aesthetic enhancement to serving as a pivotal factor in product functionality and brand identity. However, recognizing this transformation is just the beginning. For procurement professionals, what follows is understanding how texturing decisions directly influence sourcing strategy, cost structures, and supplier capabilities.

Rather than treating surface finish as an afterthought or cosmetic add-on, forward-thinking buyers now view mold texturing as a design-integrated function — one that must be clarified early in RFQs and discussed in parallel with materials, tolerances, and lead times. This shift demands a more holistic conversation that bridges the gap between design intent and production feasibility, aligning aesthetic expectations with mold longevity, tooling investment, and unit economics.

More importantly, the procurement perspective cannot be divorced from the impact of texture on operational efficiencies and product positioning. As product categories become more crowded, especially in sectors like consumer electronics, medical packaging, and industrial enclosures, surface feel and finish influence not only end-user perception but also downstream costs like coating, labeling, and secondary treatments.

With this framing, we now transition to the practical concerns of sourcing mold texturing services. The sections ahead detail key checkpoints and industrial insights that B2B buyers — from mid-sized wholesalers to OEM sourcing teams — must consider to avoid cost leakage and performance compromises.

2. Understanding Surface Texture Types

Selecting the right mold surface texture is a critical decision in B2B manufacturing procurement — one that affects not only the visual outcome but also material behavior, mold longevity, and downstream processing. For buyers, understanding how surface textures are categorized is foundational to making informed, strategic sourcing decisions.

Surface texture isn’t just about aesthetic appeal. It also influences gloss level, friction, part release characteristics, and how well a component accepts paint, adhesive, or coatings. Broadly speaking, mold texturing is applied using a few main methods, each producing unique results. These include mechanical abrasion (such as grit blasting), chemical etching, EDM (electrical discharge machining), polishing, and laser texturing.

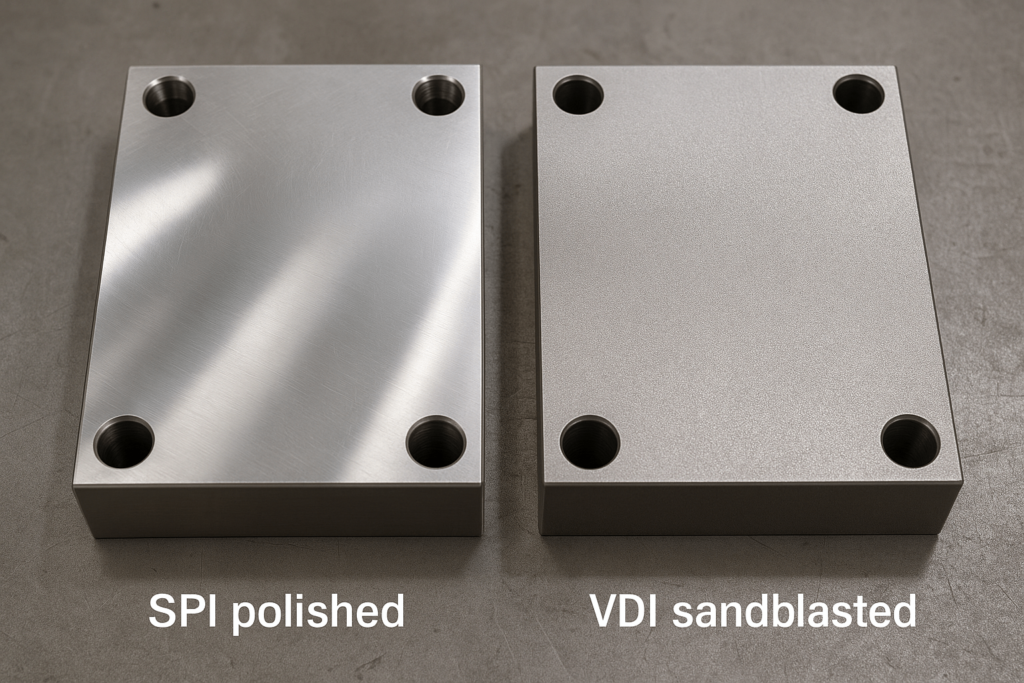

Polished textures (e.g., SPI A1–A3) are achieved using diamond or fine abrasive polishing, producing mirror-like finishes suitable for transparent parts like lenses or high-end casings. Blasted or etched textures (e.g., VDI 18–36) provide matte to rough finishes, widely used in automotive and industrial applications for grip and glare reduction.

From a procurement standpoint, understanding the classification standards is key. The most widely adopted texture standards include:

- SPI (Society of the Plastics Industry): Classifies polish levels using abrasive methods.

- VDI 3400: A German standard widely used for EDM and blasting finishes.

- Mold-Tech (MT): A proprietary standard catalog with thousands of artistic and functional textures.

Each texture standard has implications for cost, tooling complexity, and supplier specialization. For example, a MT-11010 leather grain requires skilled chemical etching and higher inspection efforts, whereas VDI-28 may be accomplished via standard EDM.

In global sourcing, it’s not uncommon for two mold makers to interpret the same texture spec differently. This makes reference samples, 3D scans, and texture plates invaluable tools during vendor qualification.

As we transition into the next section, we’ll examine how these textures serve specific technical and functional roles — and why their selection must go beyond visual preference.

3. Technical and Visual Functions of Mold Texture

Procurement teams evaluating mold texturing options must account not only for surface appearance but also for technical functionality. Texture contributes directly to part performance, user interaction, post-processing efficiency, and even compliance requirements in regulated industries.

From a technical standpoint, mold texture can significantly affect demolding behavior. Surfaces with fine matte finishes or directional grain patterns facilitate air release and minimize suction, helping to reduce cycle time and part warpage — especially in deep-draw or high-cavity molds. Conversely, overly aggressive textures may cause sticking, requiring mold-release agents that add to cost and complicate downstream finishing.

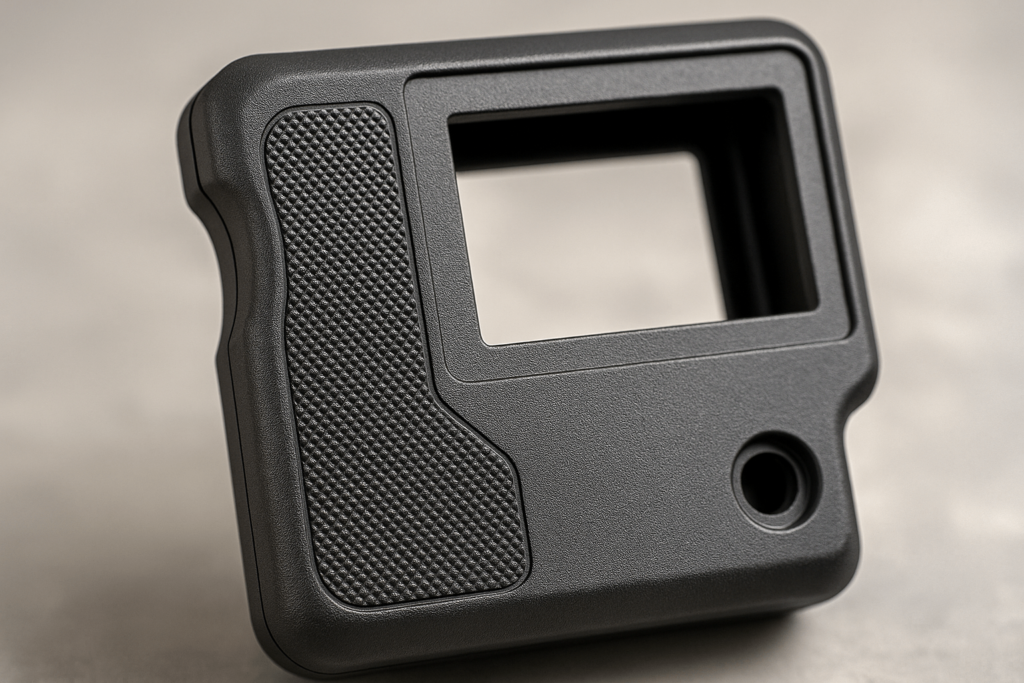

Tactile qualities are another crucial dimension. In consumer-facing products, the feel of a product can reinforce perceived quality. A lightly etched texture may signal ruggedness in a power tool handle, while a high-gloss polish suggests premium value in consumer electronics. In medical devices, anti-glare finishes not only improve user comfort under surgical lighting but also minimize contamination risk by reducing micro-crevices.

From the visual perspective, texture plays a role in brand identity and perceived cleanliness. It can mask flow lines, weld lines, or sink marks, reducing the need for secondary finishing. For example, a uniform VDI-24 texture across a plastic enclosure helps standardize appearance across batches, even with minor process variation.

Texture also affects secondary operations like painting, hot stamping, or ultrasonic welding. Surface roughness and gloss levels must be compatible with adhesion promoters or coatings. Specifying inappropriate textures can result in poor coverage or premature delamination.

Thus, for buyers, the texture selection is a multifaceted decision that touches cost, aesthetics, and functionality. Aligning the texture choice with intended use, performance expectations, and post-processing plans is essential. In the next section, we’ll dive deeper into how buyers can evaluate texturing quality — and enforce it across production runs.

4. Texture and Mold Material Compatibility

When planning a mold texturing strategy, procurement teams must consider not just the texture itself, but how well it interacts with the base mold material. This compatibility dictates tooling lifespan, achievable precision, retexturing feasibility, and overall process cost — factors that have direct implications for B2B procurement decisions.

Steel and aluminum are the two most common mold base materials, each with its own texture-related strengths and trade-offs. Steel, especially hardened tool steels like H13 or P20, offers superior durability for fine textures and high-volume production. Its resistance to wear and thermal fatigue makes it ideal for maintaining micro-textures over hundreds of thousands of cycles. Chemical etching and EDM work well on steel, enabling a wide range of textures — from deep leather grains to subtle frosted finishes.

Aluminum molds, often used in prototyping and short-run applications, offer faster machining and lower upfront costs. However, their softness poses limitations. Fine textures may degrade over time due to abrasion, and aggressive textures risk chipping or deformation. Laser etching is often preferred for aluminum, offering precise but shallow textures. Buyers must be cautious here: specifying a deep-grain MT texture on aluminum may result in texture loss or mold failure after limited runs.

Another consideration is the post-texturing treatment. Some molds require polishing or coating after texturing to control corrosion, improve release, or restore dimension. These steps must be compatible with the mold base — for instance, electroless nickel coatings work well with steel but are rarely applied to aluminum due to adhesion concerns.

From a sourcing perspective, mold material decisions affect supplier selection. Not all vendors are equally experienced in texturing aluminum versus steel. Buyers should evaluate suppliers based on their tooling material expertise, not just their texturing catalog.

Moreover, buyers must align their expectations with production scale. A VDI 30 finish on a P20 steel mold may cost more upfront but yield a longer ROI across millions of shots, whereas a similar texture on aluminum may appear cheaper initially but lead to premature mold failure.

Ultimately, successful texturing procurement involves matching surface design intent with mold material realities. This balance ensures consistency, reduces tooling risk, and optimizes lifecycle cost. In the next section, we’ll explore how procurement teams can evaluate the quality of mold textures — and enforce consistency across production batches.

5. Evaluating Mold Texture Quality and Tolerances

Evaluating the quality of mold texturing is a crucial step that procurement professionals cannot afford to overlook. Inconsistent texture application can result in uneven aesthetics, tactile differences, or even functional performance failures — all of which can generate returns, reworks, or brand perception issues.

One of the most common challenges lies in ensuring consistency across multiple cavities or tools. In multi-cavity molds, a variation in texture depth or gloss level between cavities can result in visible batch variation, which is particularly unacceptable for consumer-facing or medical-grade products. Buyers should request cavity-to-cavity texture deviation tolerances during RFQ stages and insist on verification procedures such as 3D surface scans or profilometer reports.

It’s also essential to understand the tolerance levels of different texture types. For instance, VDI textures applied by EDM have relatively stable repeatability, while chemically etched textures can show more variance if not tightly controlled. Laser textures offer high precision but may be more sensitive to substrate imperfections. Buyers should consult their suppliers on the achievable tolerances per texture method and align them with application-specific requirements.

Procurement teams should also incorporate texture review checkpoints into their quality control process. This includes first-article inspection (FAI), in-process validation, and final mold acceptance — preferably with documentation like digital surface maps, texture plates, and side-by-side samples. If the supplier outsources texturing to a third party (such as Mold-Tech), make sure those subcontractors meet certification standards and have traceable inspection systems.

Clear specification language is equally critical. Avoid vague terms like “matte” or “rough.” Instead, use standard designations (e.g., VDI-24, SPI B2) and supplement with photos, measured roughness parameters (Ra), and physical texture plaques. When ambiguity exists, disputes become harder to resolve, and enforcing warranties more complex.

Finally, procurement contracts should include acceptable variance clauses, rework thresholds, and provisions for texture touch-up or re-etching in case of tooling maintenance. Long-term supplier partnerships benefit from mutual clarity around these expectations.

In the next section, we’ll look at how poor planning around texturing introduces risks across the sourcing and supply chain continuum — and how to mitigate them effectively.

6. Supply Chain Risks in Mold Texturing Decisions

In the global manufacturing landscape, procurement decisions around mold texturing can ripple through the supply chain in complex ways. Failure to anticipate these downstream effects can lead to delays, inflated costs, or irreversible tooling issues. For B2B buyers, understanding these risk factors is essential to safeguarding production continuity and brand integrity.

One of the most overlooked risks is the inconsistency in global texture interpretation. Even when using standards like VDI or SPI, subjective variations can occur due to regional differences in etching technique, operator skill, or tooling material. A Mold-Tech MT-11010 texture applied in China may appear slightly different from the same designation produced in Europe. Without aligned physical samples or digital scans, these discrepancies can cause disputes or rejection of entire batches.

Another risk lies in supplier capabilities. Not all toolmakers or mold shops have in-house texturing capabilities, especially for specialized finishes like laser etching or deep-grain chemical patterns. Outsourcing texturing to third-party service providers introduces additional variables: lead time uncertainty, inconsistent QA standards, and miscommunication on specs. Procurement teams must vet not only the mold maker but also their subcontractor chain.

Delays in texturing can also bottleneck production timelines. Texturing often occurs after mold fabrication but before mold trials. If texturing takes longer than expected due to rework, tooling damage, or quality issues, it can derail your TTM (time to market) targets. Smart buyers include buffer time in their Gantt charts and negotiate SLAs that cover re-texturing contingencies.

Then there’s the issue of rework and repair. If a mold texture fails inspection or proves unsuitable after field testing, re-etching isn’t always feasible. Over-textured surfaces cannot be easily undone without machining or welding, which incurs high costs and potential dimensional distortion. Procurement contracts should specify acceptable ranges for texture modification and re-certification.

Intellectual property leakage is another concern when using proprietary textures. Some brands develop signature surface finishes that serve as visual IP. If these are textured in regions with weak IP enforcement, there’s a risk of knock-offs or unauthorized replication. NDA coverage, supplier audits, and trademarking unique textures can help mitigate this.

Finally, shipping and packaging of textured molds require care. Improper protection during transport can damage or oxidize textured areas, especially with aluminum molds. Procurement teams should confirm packaging protocols, especially when molds transit long distances or change climates.

To proactively address these supply chain vulnerabilities, procurement professionals should build a mold texturing checklist covering supplier capability, subcontractor transparency, IP protections, QA documentation, and logistics readiness. In the next section, we’ll explore actionable sourcing strategies tailored for mold texturing projects.

7. Strategic Sourcing Tips for Mold Texturing in B2B Projects

Navigating the sourcing landscape for mold texturing requires a strategy that accounts for both technical nuance and commercial leverage. For B2B buyers, especially those managing multi-tiered supplier relationships or international tool procurement, mold texturing becomes a pivotal aspect of sourcing complexity. This section outlines actionable strategies procurement professionals can implement to streamline supplier qualification, reduce hidden costs, and ensure long-term texture consistency.

1. Prioritize Early Engagement During Design Freeze

Many buyers introduce mold texturing discussions too late — often post-tooling signoff. This reactive approach can result in rushed texture choices, unclear tolerances, or costly post-fabrication changes. Best-in-class procurement teams advocate for texture decisions during the DFM (Design for Manufacturability) phase. At this stage, molders, designers, and texture providers can co-evaluate feasibility, recommend standard texture callouts, and flag potential demolding issues. The earlier these stakeholders align, the smoother the tool build and production ramp will be.

2. Build a Qualified Vendor List by Texture Specialty

Not all toolmakers excel at all textures. A supplier with EDM expertise may not deliver high-fidelity chemical etching. Categorize your vendor list by core strength — laser texturing, deep grain etching, high-polish finishes, etc. When issuing RFQs, tailor your shortlist to match the texture spec. Over time, develop texture-specific benchmarks like defect rates, repeatability variance, or rework frequency. This enables granular vendor comparison and drives long-term value.

3. Include Texture Plates and Digital Files in RFQs

One of the most effective sourcing tactics is the inclusion of texture plaques (physical samples) and 3D texture CAD files or digital grayscale maps. These assets remove ambiguity and allow vendors to price accurately based on pattern depth, complexity, and tool accessibility. Including these in RFQs also enables apples-to-apples quotation and minimizes scope creep during project execution.

4. Clarify SLA Terms for Texture Quality, Repair, and Repeatability

Standard SLAs often overlook texturing-specific obligations. Contracts should define texture quality acceptance ranges (e.g., Ra variation limits), rework allowances (e.g., one-time re-etching within ±5% spec deviation), and maintenance cycles (e.g., texture refresh after X shots). SLAs should also address who bears responsibility for retexturing after tool maintenance or damage. These guardrails minimize dispute risks and provide recourse without renegotiation.

5. Diversify Regional Supply Chain Dependencies

Relying on a single country or supplier for all mold texturing can create risk exposure, especially in volatile trade or regulatory environments. Consider regional diversification: partner with a primary texture supplier in Asia, but qualify a backup vendor in Eastern Europe or North America. Even if the backup is rarely activated, their existence strengthens your negotiating position and provides a fallback during crisis scenarios.

6. Leverage Local Service Bureaus for Texture Repair

For molds shipped overseas, texture damage in transit or post-use may require local touch-up. Pre-qualify regional texturing service bureaus (e.g., Mold-Tech satellite facilities) near your production hubs. Build commercial relationships so that urgent repairs don’t require shipping tools internationally. This move reduces downtime and improves resilience.

7. Integrate Mold Texturing Metrics into Supplier Scorecards

Too often, mold texturing is evaluated only during FAI and forgotten thereafter. Mature procurement teams integrate texture compliance KPIs into ongoing supplier scorecards: first-time acceptance rates, surface defect incidence, and adherence to aesthetic consistency. Over time, these data help shape sourcing allocations, continuous improvement targets, and long-term partnerships.

With these sourcing levers, buyers can elevate mold texturing from a quality risk to a competitive asset. In the next section, we will explore how different industries demand specific textures — and how that should influence sourcing decisions by sector.

8. Applications by Sector: Texture Demands Across Industries

While mold texturing standards and sourcing strategies apply across the board, the nuances of texture selection shift dramatically depending on the end-use industry. For B2B procurement professionals, understanding these sector-specific requirements is key to making informed sourcing decisions that align with customer expectations, regulatory environments, and lifecycle performance metrics.

Automotive and Transportation

In the automotive industry, mold textures serve both aesthetic and ergonomic purposes. Dashboard panels, HVAC vents, gear knobs, and interior trims often require consistent matte finishes to reduce glare and ensure a uniform tactile feel. Textures must meet OEM specifications such as Ford’s FLTM or GM’s GMN standards, in addition to standard SPI/VDI designations. Here, the ability to withstand UV exposure, abrasion, and repeated cleaning is critical.

Procurement teams sourcing for this sector should prioritize texturing partners with a proven record of Tier 1 automotive compliance. Additionally, ensure suppliers can manage tool replication for global plant deployment — meaning the exact same texture must be repeatable across different regional tooling vendors.

Medical Devices and Healthcare

Medical products often require mold textures that support hygienic function while enhancing user comfort. In surgical tools or diagnostic devices, anti-glare, satin-like finishes reduce visual fatigue under operating room lighting and help conceal fingerprints. More importantly, these surfaces must minimize micro-crevices where contaminants could accumulate.

Procurement must account for ISO 13485 or FDA QSR compliance among mold texturing vendors. Furthermore, documentation and traceability for surface roughness (e.g., Ra values between 0.2–0.8 μm) should be built into supplier quality agreements. Selecting suppliers with cleanroom-adjacent processing or post-texturing sterilization support can further enhance value.

Consumer Electronics

In handheld devices and enclosures, mold textures are closely tied to brand differentiation. A subtle leather grain or brushed-metal simulation can evoke a premium feel, while also concealing molding marks and enhancing grip. Apple, Samsung, and Logitech all use proprietary texture patterns as part of their industrial design DNA.

Procurement should focus on vendors offering digital laser texturing and grayscale mapping capabilities, enabling high-resolution, repeatable finishes across global supply chains. Protection of proprietary surface designs (via NDAs and controlled file distribution) also becomes essential in this IP-sensitive sector.

Industrial Equipment and Enclosures

For ruggedized housings, control panels, or equipment casings, mold texturing aids in function and maintenance. Coarse matte textures improve grip when operators wear gloves, while masking wear from frequent contact. Chemical resistance and ease of cleaning are added considerations in sectors like oil & gas or food machinery.

In this segment, cost-effective EDM or grit-blasted textures often suffice, and aluminum tooling is more common due to lower volume demands. Procurement teams must verify that the tool material-texture combination delivers sufficient longevity, and that textures are compatible with powder coating or overmolding operations.

Packaging and Consumer Goods

Texture in product packaging — particularly in cosmetics, luxury items, and retail goods — enhances tactile engagement and shelf appeal. Satin, velvet, and leather-simulating finishes are common. Mold-Tech and other catalog houses offer pre-designed grains that align with branding needs.

Here, speed to market is often critical. Procurement can gain agility by working with suppliers who maintain in-stock texture rollers or who offer digital proofs for rapid customer approval. Texture consistency across large-volume production and multi-cavity molds must be documented and validated early.

Understanding these sector-specific demands empowers procurement teams to tailor sourcing strategies and texture specifications based on use-case realities. In the final section, we distill key takeaways to guide procurement managers toward a more confident, standardized approach to mold texturing decisions.

9. Conclusion and Practical Takeaways for Procurement Teams

Mold texturing is no longer a niche detail reserved for designers or toolmakers. For procurement professionals operating in high-stakes, globally distributed manufacturing environments, surface texture decisions directly affect project timelines, product consistency, brand equity, and cost efficiency. As this guide has outlined, approaching mold texturing with a strategic, cross-functional mindset is essential.

The first key takeaway is the importance of early engagement. Texture discussions must start as early as the DFM stage — long before tooling begins. This allows sourcing teams to flag feasibility risks, assess supplier specialization, and align visual expectations with production realities.

Second, buyers must evolve beyond relying solely on catalog codes (e.g., VDI-28 or MT-11020). These standards serve as important baselines, but visual and tactile outcomes are still subject to interpretation. Procuring physical plaques, conducting side-by-side texture comparisons, and integrating digital surface mapping should become standard practice for critical projects.

Third, supplier selection needs to be texture-capability-specific. The same moldmaker who delivers stellar SPI A2 polishes may fall short when asked to execute a deep-grain chemical etch or high-resolution grayscale laser pattern. Segmenting supplier rosters by texturing strength — and tracking metrics like repeatability, rework rates, and response time — gives buyers a sharper decision-making framework.

Fourth, procurement teams must embed enforceable QA language and texture KPIs into their documentation and contracts. These can include acceptable Ra ranges, tolerance variances, rework terms, and post-maintenance re-certification protocols. These safeguards help reduce subjectivity and ensure that texture quality is measured with the same rigor as dimensional tolerance.

Fifth, supply chain visibility is non-negotiable. Whether it’s understanding which subcontractor is performing the texture work or having contingency plans for local repair bureaus, buyers need to build texturing resilience into their supplier ecosystem. This is especially true for international tool builds and multi-regional rollouts.

Lastly, sector-specific texture demands should guide sourcing strategy. What works for automotive interiors may be inappropriate for sterile medical housings. Procurement teams must educate themselves on end-use standards and regulatory implications to avoid costly redesigns or compliance failures.

In summary, mold texturing is both an art and a science — one that procurement leaders must master to deliver quality, consistency, and efficiency. Those who treat texturing as a strategic lever rather than a post-design obligation will unlock competitive advantages in speed, quality, and brand impact.

Equipped with the insights in this guide, buyers can lead cross-functional conversations, anticipate risks, and build high-performing vendor partnerships that elevate both the function and form of molded components.