Introduction

Choosing the right molding process isn’t just about materials and machines—it’s about delivering value in production, scalability, and consistency. For international procurement managers, OEM buyers, and volume production sourcing teams, this decision directly affects unit economics, supply chain reliability, and time-to-market.

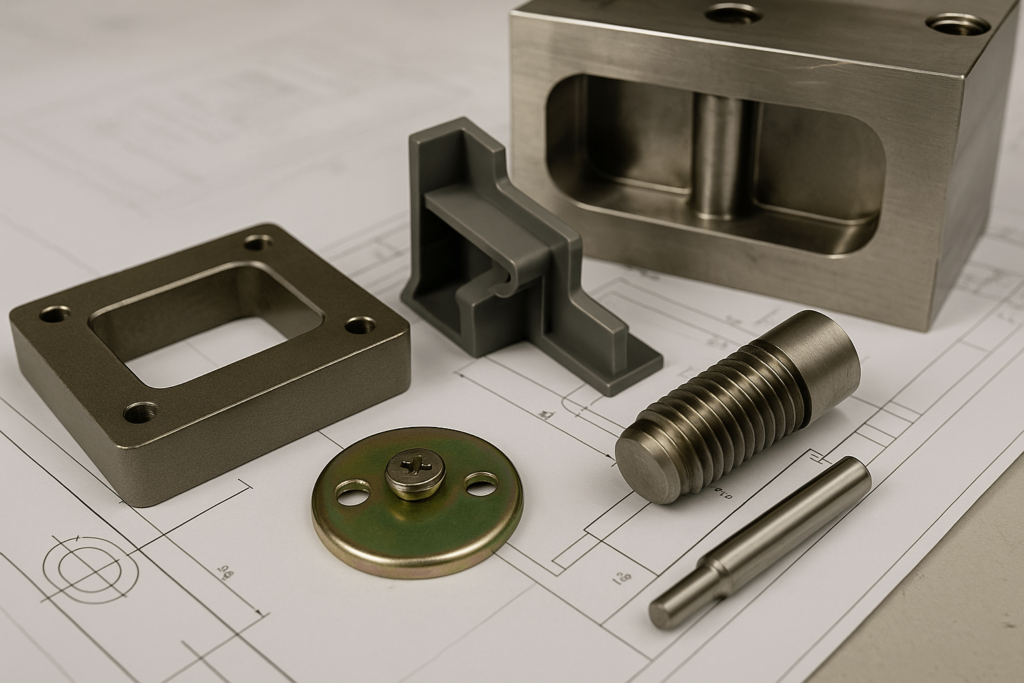

This guide compares compression molding and injection molding across practical factors relevant to bulk buyers and sourcing teams. From tooling costs and lead times to part tolerances and lifecycle benefits, we focus on what truly matters in procurement: cost-efficiency, quality, and performance. With added references to real industrial standards, typical low-volume tooling decisions, custom metal parts sourcing needs, and export-based procurement cases, this article is built to help you make informed supplier choices.

Understanding the Core Technologies

What is Injection Molding?

Injection molding is widely used in mass production. The process involves injecting molten thermoplastics into precision-machined molds under high pressure. After cooling, parts are ejected and ready for post-processing.

For procurement teams targeting high-volume programs—like automotive injection parts or medical device casings—this method ensures consistent tolerances and repeatability. Applications of injection moulding include casings, enclosures, gears, and even structural frames when fiber-reinforced plastics are involved.

The benefits of injection moulding extend beyond speed. Tight tolerances (±0.05 mm), surface finish uniformity, and multi-cavity output allow large batch consistency. Aluminum molds for injection molding are increasingly adopted for prototyping or mid-scale production due to their faster lead times and proven durability.

This is particularly relevant for industrial molded components procurement, where quality consistency and supply security are essential.

What is Compression Molding?

Compression molding is often the better fit for thermosets, rubbers, and fiber-reinforced composites. This process involves placing pre-measured materials into heated molds, applying pressure, and holding until the part cures.

Used for lower- to medium-volume runs, this method excels in parts requiring mechanical strength and heat resistance—common in the electrical, agricultural, and heavy industrial sectors.

For procurement teams focusing on low-volume metal forming or hybrid part production, compression molding simplifies both cost and lead time.

The process aligns well with ASTM D3182 for rubber molding practices and is preferred for components where dimensional accuracy is less critical than material performance.

If you’re sourcing large-format or structurally reinforced parts like electrical panels or gasket assemblies, compression molding provides excellent control and simplified mold development.

Common Ground: Where the Two Methods Align

Both processes share foundational elements: they use matched metal tooling, rely on heat and pressure, and support materials suited to their specific curing or cooling requirements.

For example, aluminum injection mold tools can be used in both compression and injection formats, especially in prototyping environments. Sustainability also aligns—both methods now support bio-resins and closed-loop material reuse, particularly in large-volume operations.

However, despite functional overlap, operational differences dominate procurement outcomes.

Key Differences That Impact Procurement

Tooling and Initial Investment

Injection molding tools are complex, often designed with cooling channels, hot runners, and ejector systems. This level of sophistication brings long mold lifespans—especially with hardened steel—but also high entry costs.

In contrast, compression molds are simpler, cheaper, and faster to produce. For example, a typical aluminum injection mold may cost 30–60% less than its steel counterpart. For lower batch sizes or trial programs, compression tooling minimizes CAPEX exposure, making it ideal for low-volume metal forming projects.

Speed and Output Efficiency

Cycle times in injection molding can be under 60 seconds, making it ideal for assist injection systems and continuous production lines. Automotive injection applications particularly benefit from short-run optimization using aluminum injection molding setups.

Compression molding cycles range from 1 to 6 minutes, depending on material and part thickness. For thicker thermoset parts or components requiring slower cure rates, this slower pace is acceptable—and even preferable to reduce internal stresses.

Materials and Lifecycle Performance

Injection molding is optimized for thermoplastics, especially when regulatory performance is needed (UL Yellow Card-listed materials, ISO 178 flexural strength). Aluminum injection molds support these materials with improved tool life under moderate pressure loads.

Compression molding thrives on high-heat, chemically stable polymers. Metal injection molding vs die casting comparisons often highlight that compression-style molding supports materials too brittle or abrasive for die casting, offering better fatigue resistance.

Importantly for metal parts manufacturers, compression molding also accommodates composite parts with metal inserts in plastic overmolding—commonly seen in electrical connectors, shielding enclosures, and structural frames with integrated fasteners. This makes it especially relevant when sourcing metal-plastic hybrid components or metal-backed industrial enclosures.

If your industrial molded components procurement requires resilient thermoset materials or high-temperature resistance, compression molding is often more cost-effective at scale.

Design Complexity and Procurement Implications

Injection molding enables fine features: logos, microchannels, snap fits. These are crucial for industries like consumer electronics or healthcare, where tight tolerances and lightweighting matter.

However, greater complexity means longer design-to-tool timelines. For rapid response or aggressive launch schedules, aluminum injection molding offers agility with cost containment.

Compression molding offers less flexibility in geometry but simplifies procurement workflows. Fewer mold changes and post-processing steps make this ideal for parts where cosmetic finish is not a priority.

Maintenance, Waste, and Sustainability

Tool maintenance differs significantly. High-pressure injection molds often require scheduled cleaning and component replacement. By comparison, compression molds see fewer mechanical failures, and less thermal cycling stress.

Waste levels also differ. Injection processes generate runners and sprues unless hot runners or assist injection techniques are used. Compression molding produces less scrap overall, especially when using pre-cut charges or automated dosing.

For buyers prioritizing lean supply chains, these factors impact overall yield and batch rejection rates.

What Bulk Buyers Should Evaluate

For international buyers managing unit economics, lead time, and supply risk, molding choice shapes project ROI.

Volume: If your demand is >100,000 units/year, injection molding with hardened steel or aluminum injection mold setups is optimal. For <10,000 units, compression molding minimizes tooling amortization.

Material Fit: If UL, RoHS, or ISO-certified thermoplastics are required, injection molding aligns better. For silicone, EPDM, or reinforced phenolics, compression molding is safer and more scalable.

Lead Time: Aluminum injection mold tools can be fabricated in 10–15 days. Compression molds often require less.

Part Geometry: Products needing tight tolerances or thin walls should use injection. Gasket-style, structural, or solid-profile parts may favor compression.

Typical Use Cases for Procurement Teams

Use Injection Molding When:

Procuring consumer-facing plastic components with branding or surface polish requirements.

Running high-volume SKUs in multiple regions, where spare tool sets help balance load.

Needing short product cycles with rapid re-engineering (e.g., aluminum molds for injection molding allow quick adjustments).

Use Compression Molding When:

Requiring rubber, thermoset, or fiberglass parts for industrial equipment.

Sourcing locally in Asia with suppliers like YISHANG offering hybrid production models.

Managing batch orders where unit consistency matters more than fine detail.

Common Buyer Misconceptions

Even experienced procurement professionals can encounter misunderstandings when sourcing molded parts. Below are some common issues that lead to unexpected costs or delays:

1. Believing All Quotes Include Post-Processing: Compression molding often requires secondary trimming or surface finishing that is not included in initial quotes. Always clarify whether services like de-flashing, painting, or assembly are part of the offer.

2. Assuming Mold Lifespan Is Uniform: Not all molds offer the same tool life. For example, aluminum injection mold tool life is typically 50,000–100,000 shots, while hardened steel molds can exceed 1 million. This affects long-term unit cost.

3. Expecting Equal Tolerances Across Methods: Compression molding cannot offer the same dimensional precision as injection molding. Don’t apply injection molding tolerance standards to thermoset projects—doing so may cause unnecessary rejection or mold revision.

4. Treating Thermoplastics and Thermosets as Interchangeable: Thermoplastics used in injection molding behave differently than thermosets in compression molding. Selecting the wrong material system can result in product failure or non-compliance with standards like UL or RoHS.

Being aware of these points helps avoid miscommunication with suppliers and leads to smoother, cost-effective production.

Comparison Table: Supplier-Facing Metrics

| Criteria | Injection Molding | Compression Molding |

|---|---|---|

| Tooling Cost (Initial) | $10,000–$100,000+ | $3,000–$40,000 |

| Tool Lead Time (avg.) | 3–6 weeks (steel), 2–3 weeks (aluminum) | 1–2 weeks |

| Cycle Time | 10–60 seconds | 1–6 minutes |

| Batch Suitability | Best for 50k+ | 500–20k |

| Complexity Capability | High | Low to Medium |

| Surface Finish Quality | High | Medium |

| Regulatory-Grade Materials | Thermoplastics (UL, ISO, RoHS) | Thermosets, rubbers, FRP |

| Mold Longevity (cycles) | Up to 1M+ (steel), ~100k (aluminum) | 30k–100k |

Real Sourcing Scenario Example

A European OEM buyer working in the renewable energy sector approached YISHANG with a requirement for 8,000 weather-resistant connector housings. The material spec called for UL-listed thermoplastics with a life expectancy of 10 years outdoors.

After evaluating injection molding and compression molding, we recommended aluminum molds for injection molding due to the precise dimensions and surface finish required. The tooling was ready in 14 days. Despite the small batch, the ROI was justified through reduced post-processing and scrap.

This case illustrates how material constraints, batch size, and lifecycle expectations guide the best process decision—not just tooling cost.

Closing Thought

Whether you’re managing a high-speed global rollout or a custom industrial tooling order, molding choice is a procurement decision—not just an engineering one. The path to ROI depends on how well your process choice matches your volume, part design, and supply priorities.

YISHANG supports both compression and injection molding with tooling built for scale, flexibility, and sourcing efficiency.

Ready to discuss your next project? Contact YISHANG for a fast quote and technical evaluation.