For overseas wholesale buyers, plate cutting is rarely evaluated as “just cutting.” It is judged by outcomes: whether parts arrive consistent, whether batches assemble without adjustment, and whether repeat orders behave like the first shipment. When delivery slips, rework grows, or assembly teams start “fitting by hand,” the root cause often traces back to one early and irreversible operation—plate cutting.

Once steel plate cutting begins, three things become difficult to change later: geometry, cut-edge condition, and thermal influence. Every downstream operation—bending, welding, CNC machining, surface finishing, inspection, packaging—must work within those constraints. For procurement, that means plate cutting decisions influence lead-time stability, batch repeatability, total manufacturing cost, and the supplier’s ability to scale with you.

This article is written for international B2B buyers sourcing metal parts in volume. It focuses on practical manufacturing outcomes and supplier evaluation, not marketing claims. You will see industry terminology (kerf, HAZ, dross, edge taper, tolerance stack-up) explained in plain language. You will also find buyer-centric benchmarks, a few standard references, and examples of how to translate cutting quality into purchasing decisions.

Plate Cutting as the First Irreversible Manufacturing Decision

Most sourcing projects begin with a drawing, a material grade, and a target price. But manufacturing reality begins when a plate is physically transformed. In many fabrication workflows, that transformation starts with plate cutting, turning raw stock into near-net shapes that later become brackets, frames, housings, racks, panels, or structural components.

For wholesale buyers managing repeat production, this step deserves attention because it cannot be undone. Once a plate is cut, later processes can only compensate, not reset. An inconsistent cut edge quickly turns welding preparation into a variable task rather than a standard one. Profile drift has a similar cascading effect, pulling bend lines and hole patterns out of alignment downstream. Uncontrolled heat input adds another layer of risk, introducing distortion that often only becomes visible once a batch is already in motion.

From a sourcing standpoint, plate cutting is also where variability first enters a supply chain. Two suppliers can quote the same DXF file and the same material, yet deliver different assembly time, different scrap rates, and different rework levels. Understanding cutting’s role helps you separate a low unit price from a supplier that can deliver stable output over multiple production cycles.

What wholesale buyers are really buying at the cutting stage

In volume purchasing, the real deliverable is not a cut part. It is a predictable process. Buyers care about repeatability because their downstream costs—labor, inspection, warranty exposure—depend on it. When a supplier’s plate cutting is stable, you can standardize fixtures, weld sequences, and inspection routines.

When plate cutting is unstable, the rest of the process becomes reactive. Operators grind more. Welders slow down to bridge inconsistent gaps. Assemblers elongate holes or shim parts. Those “small” corrections are expensive because they multiply across hundreds or thousands of parts, and they often appear as hidden cost rather than line-item price.

What Plate Cutting Defines—and What It Does Not

Plate cutting defines the external contour and the initial geometry of a part. Modern cutting systems can maintain consistent kerf compensation, repeatable lead-ins, and stable piercing for many industrial profiles. For large, non-functional cutouts and general profiles, cutting is an efficient way to create near-net parts with good throughput.

However, plate cutting alone rarely defines functional precision. Features that control alignment, sealing, load transfer, or datum relationships—such as precision holes, locating slots, or mating edges—often require tighter control than cutting can economically guarantee, especially when you account for downstream processes and tolerance stack-up.

For buyers, the practical message is simple: cutting is excellent for geometry, but function often needs a finishing plan. The supplier that explains this clearly is usually more dependable than the supplier who simply promises to “hold any tolerance” on the cut.

A tolerance budget is more useful than a tolerance number

A common procurement mistake is applying uniform tight tolerances to all cut features. This increases cost and still does not guarantee assembly efficiency because bending and welding introduce variation too. A better approach is to treat tolerance like a budget.

Use plate cutting to establish overall shape and reserve secondary machining for the small set of features that truly drive fit and performance. For example, if a hole pattern locates a hinge or aligns a bracket, it may be smarter to cut a pilot hole and finish it with drilling, reaming, or CNC machining. This strategy reduces rework, supports repeatability, and keeps total cost predictable.

Long-tail terms buyers use—and what they mean in practice

Buyers often search phrases like “plate cutting tolerance,” “cut-to-size steel plate,” or “precision steel plate cutting.” In practice, these searches usually represent a need for dependable assembly results, not an obsession with microns.

A strong supplier response is not a generic tolerance claim. It is a practical plan: where cutting is sufficient, where machining is needed, and how inspection will verify what matters.

Edge Condition: Where Cutting Quality Becomes Assembly Cost

In many RFQs, edge quality is assumed rather than defined. Yet in volume production, cut-edge condition is one of the most influential outcomes of plate cutting. Burrs, dross, edge taper, and oxidation are not cosmetic details. They change welding time, coating adhesion, gasket performance, and fit-up consistency.

In steel plate cutting, inconsistent edges create hidden cost because they force manual correction. Burrs prevent parts from seating flat and can create safety risks in handling. Dross on thermal cuts interferes with weld prep and increases grinding time. Oxidized edges reduce coating adhesion, especially at corners and exposed edges where corrosion often begins.

From a buyer’s perspective, predictable edge quality is more valuable than an impressive-sounding cutting method. When edges are consistent, downstream processes can be standardized. When edge condition varies from batch to batch, labor hours rise and delivery schedules become harder to control.

Edge condition is a purchasing variable, not a cosmetic preference

If you buy parts that will be welded, ask what the supplier considers “weld-ready.” A weld-ready edge usually means minimal adherent dross, controlled roughness, and consistent geometry at the root. If you buy parts that will be powder coated or painted, ask how the supplier prevents edge contamination and how they handle deburring.

For many industrial products—metal cabinets, racks, frames—edges are where defects show first. This is why buyers often experience customer complaints at corners and seams before they see issues on large flat surfaces. Improving edge condition is often the fastest way to reduce downstream defects.

Practical inspection language that reduces disputes

Edge quality is hard to specify with a single number, but buyers can still communicate clearly. Instead of only listing tolerances, define the functional expectation.

For example, specify whether grinding is acceptable, whether edges must be suitable for coating after standard cleaning, or whether mating edges must be burr-free to avoid stand-off. This turns “quality” into an actionable requirement.

A standard reference worth knowing: ISO 9013

For thermal cutting, ISO 9013 is commonly used to describe cut quality characteristics such as perpendicularity (edge taper) and surface roughness for thermal cuts. You do not need to quote the full standard in an RFQ, but referencing “ISO 9013 cut quality expectations” can help align terminology between buyer and supplier.

Heat Input and the Heat-Affected Zone in Plate Cutting

Heat is not simply a by-product of cutting. In thermal processes, it is a variable that affects geometry and material behavior. The heat-affected zone (HAZ) can alter microstructure near the cut edge, influencing hardness, corrosion behavior, and distortion risk. These effects become more visible as geometry grows complex, as thickness varies, or as the part later sees welding heat.

For buyers sourcing stainless steel parts, heat matters in two ways. First, edge discoloration and oxide scale can affect finishing and corrosion resistance if not controlled. Second, thermal stress introduced during cutting can cause warping later—sometimes only after the part is removed from the table, bent, or welded.

For structural steel components, heat matters because distortion changes fit-up and weld gaps. When weld gaps vary, weld speed slows, distortion increases further, and rework climbs. The cutting stage can either reduce or amplify this chain reaction.

Thermal footprint: the term buyers should care about

A helpful concept is the “thermal footprint.” This is the combination of heat input, cut sequencing, and part support that determines how much residual stress and distortion are introduced. Two suppliers can use similar equipment yet produce different thermal footprints because of different parameters and cutting strategy.

For a buyer, the best question is outcome-based: can the supplier control distortion to meet your assembly needs? If a supplier can explain how they sequence cuts to reduce heat buildup on thin webs or how they fixture large panels to keep flatness, that is a meaningful signal of competence.

Downstream compatibility is the real goal

Evaluating plate cutting quality means looking beyond the cut itself. A cutting method that is fast and economical may still be a poor choice if it creates instability in welding, bending, or coating. The right approach is the one that fits your process chain.

In procurement terms, the goal is not to buy “the best cutting method.” The goal is to buy a cutting approach that protects downstream yield and delivery.

Plate Thickness as a Decision Variable

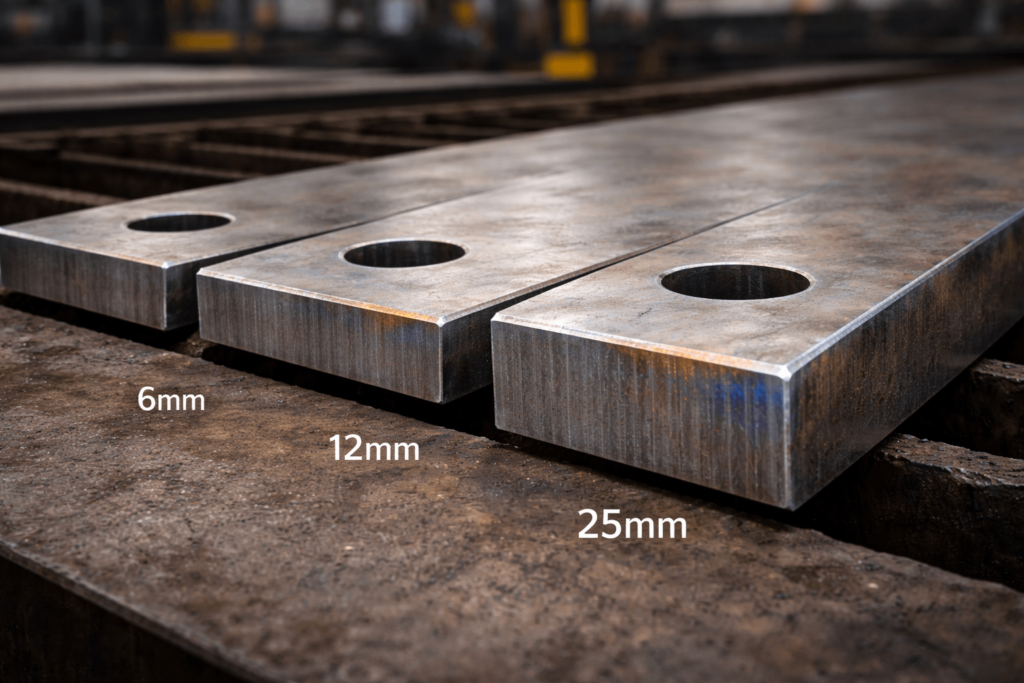

Thickness fundamentally changes how plate cutting behaves. Thin plate reacts quickly to heat and can distort during long cuts, especially in large panels, frames, and parts with many internal features. Thick plate requires higher energy input and careful control of kerf geometry to maintain consistent edge taper and dimensional stability.

For thick steel plate cutting, the challenge is not only penetration. Edge taper, kerf width variation, and thermal gradient all influence how parts fit during welding. A small change in taper on thick material can show up as a large gap during assembly.

For thin plate, the risks are often about flatness and “oil-canning.” If the part moves during cutting, later bending becomes inconsistent and assembly holes may no longer align as expected.

Thickness interacts with geometry and quantity

Thickness alone doesn’t determine risk. Geometry and batch size matter too. A complex profile with long continuous cuts behaves differently than a simple rectangle. A first-off prototype can be corrected by hand; a thousand-part order cannot.

For wholesale buyers, this is why a supplier’s approach to thickness is a good indicator of whether they can scale. Ask how they manage distortion on large thin panels. Ask what quality checks they apply on thick plate to confirm taper and edge condition.

Common sourcing queries this section addresses

This section addresses common sourcing queries buyers use when comparing suppliers, such as “thick plate cutting,” “steel plate cutting service for thick material,” and “plate cutting distortion control.” Covering these topics helps align your requirements with the right process plan—especially when thickness, flatness, and fit-up are critical.

Choosing a Cutting Method: Buyer-Relevant Trade-Offs (Without the Marketing)

Many top-ranking pages for plate cutting and steel plate cutting win clicks by naming processes—laser, plasma, oxyfuel, waterjet—and giving quick comparisons. That approach works because buyers often search those terms when they are uncertain which route will protect their order. The gap is that most pages stop at “pros and cons” and don’t translate the differences into procurement outcomes.

A useful way to think about method selection is to focus on three outputs that affect your production line: dimensional repeatability, edge condition, and thermal footprint. For example, kerf width influences how accurately small features can be held, and edge taper influences how thick plates fit-up before welding. Heat input affects flatness and residual stress, which then affects bending accuracy and weld gap consistency.

Industry guidance commonly describes laser as producing the smallest kerf and least edge deviation, with plasma typically in the middle and oxyfuel producing a larger kerf and larger heat influence. Practical references also show typical tolerance bands: laser often tighter than plasma, plasma tighter than oxyfuel, with the caveat that thickness, operator setup, and machine condition all matter. The point is not to chase the tightest number everywhere—it is to match the process to what your assembly can tolerate.

A quick comparison buyers can actually use

| Method (common in plate cutting) | Where it tends to work well | What to watch for in volume | Buyer takeaway |

|---|---|---|---|

| Laser cutting | Thin to mid thickness parts with fine features and tight fit-up needs | Fume control, material reflectivity, thickness limits, cost on heavy plate | Strong for detail and repeatability when thickness is appropriate |

| Plasma cutting | Mid thickness steel parts, strong throughput, good general-purpose profiles | Edge taper and dross management at higher thickness, small-hole quality | Often a good balance of speed and fit-up when cut quality is controlled |

| Oxyfuel (flame) cutting | Very thick carbon steel plate and heavy structural work | Larger HAZ, more scale/dross, slower cycle times | Best when thickness drives the decision and post-cut cleanup is planned |

| Waterjet cutting | Heat-sensitive materials, thicker sections where thermal effects are unacceptable | Slower throughput, higher cost, abrasive handling and waste | Useful when avoiding HAZ protects downstream quality or corrosion behavior |

If you are buying welded assemblies, ask which method produces edges that are “weld-ready” for your weld procedure and finish. If you are buying coated products, ask what edge condition and surface prep the supplier delivers before finishing. These questions align selection with risk and prevent surprises after the first shipment.

Translate method choice into RFQ language

Instead of writing an RFQ that simply says “steel plate cutting,” describe the downstream reality. For example: “Parts will be welded into frames, then powder coated; mating edges must seat without stand-off; flatness must support press brake operations.” This gives the supplier enough context to choose parameters, sequencing, and any secondary operations that protect your outcomes.

Why Plate Cutting Alone Rarely Meets Assembly Requirements

In batch production, assembly issues often stem from tolerance accumulation rather than a single out-of-spec dimension. Plate cutting establishes the baseline geometry, but bending, welding, coating thickness, and hardware tolerances each introduce variation. If cutting consumes most of the tolerance budget, downstream processes have little margin to absorb real-world variation.

This is why experienced fabricators treat plate cutting as near-net, not final. Critical features that control alignment or sealing are often finished after cutting through drilling, tapping, or CNC machining. This approach improves assembly consistency and reduces corrective labor across production runs.

From a procurement standpoint, understanding where cutting ends and secondary processing begins helps you compare quotes fairly. Two suppliers may quote different routes for the same drawing: one relies on cutting to meet all requirements, while the other plans controlled finishing for critical features. The second approach often yields better repeatability, even if the cutting line item is not the lowest.

Cutting + machining is often a reliability strategy

Buyers sometimes search for “combination burning and machining,” “cutting and drilling,” or “CNC after plate cutting.” These searches reflect a need for functional geometry.

If an assembly depends on accurate hole location, square interfaces, or consistent bolt patterns, a planned machining step can protect yield. It also makes inspection easier because key features are defined by machining rather than by variable edge condition.

What to ask in an RFQ without turning it into a checklist

Instead of asking for a long list of capabilities, ask how the supplier will protect your assembly-critical features. Ask what features they will finish after cutting, and how they will inspect those features.

This keeps the conversation focused on outcomes, which is exactly what wholesale buyers need when deciding between suppliers.

The Hidden Cost of Plate Cutting in Volume Production

Quoted cutting price rarely reflects true manufacturing cost. The real cost of steel plate cutting often appears later as manual deburring, straightening, weld rework, or extended inspection time. These costs accumulate quickly in volume production, and they directly affect delivery performance.

A practical way to evaluate suppliers is to look for cost multipliers that show up after cutting. When cut edges regularly require heavy grinding, the cost shows up as additional labor and greater process variability. Parts that need straightening introduce delays and expand inspection effort. Inconsistent weld fit-up is even more expensive, slowing welding operations first and then driving rework when defects appear.

When procurement teams focus only on unit price, these multipliers remain invisible until the first production run is underway. When they focus on total cost and repeatability, they can avoid predictable problems.

A buyer-friendly table: connecting cutting outputs to purchasing risk

| Cutting Output You Can Ask About | Why It Matters to Wholesale Buyers | Typical Downstream Cost if Uncontrolled |

|---|---|---|

| Burr height / sharp edges | Impacts safe handling and fit-up on mating surfaces | Deburring labor, stand-off during assembly |

| Dross / slag adherence | Affects weld prep and coating quality | Grinding time, weld defects, coating touch-up |

| Edge taper / perpendicularity | Drives gaps on thick plate fit-up | Slow welding, extra filler, distortion correction |

| Distortion / flatness | Impacts bending accuracy and panel assembly | Straightening, scrap, delayed delivery |

| Batch-to-batch consistency | Determines whether repeat orders behave predictably | Fixture adjustments, inspection escalation |

This is not a strict standard. It is a procurement tool that helps you translate technical quality into risk and cost.

A realistic example of “hidden cost” in repeat production

Imagine a bracket that looks fine on arrival but requires five minutes of grinding per part before welding. On a 2,000-piece order, that is roughly 166 labor hours. Even at a conservative labor rate, the grinding cost can exceed the entire price difference between suppliers.

This is why many buyers see “cheap cutting” become expensive in production. The remedy is not to demand perfection everywhere. The remedy is to align cutting outputs with downstream requirements and to validate those outputs early—on first articles—before volume ramps.

How Experienced Fabricators Approach Plate Cutting Decisions

Experienced fabrication teams begin with function, not equipment. They identify which surfaces control assembly, where distortion would be unacceptable, and which features require tight positional accuracy. Only then do they select the cutting approach and secondary operations that best protect the final outcome.

For buyers, adopting this mindset improves supplier evaluation without requiring deep process expertise. It changes the conversation from “Do you offer laser, plasma, or waterjet?” to “How will you ensure this assembly goes together consistently across batches?”

That shift matters because a supplier can list many processes and still deliver variable results. What you want to hear is a stable plan: how the supplier will manage edge condition, heat input, thickness effects, and inspection priorities.

Outcome-based questions that improve supplier selection

If you are sourcing plate-cut components for repeat production, ask questions framed around manufacturing results.

Ask how the supplier plans to control distortion on large panels, and what indicators they use to confirm flatness. Clarify what cut quality they consider weld-ready for your specific weld procedure and finish. Discuss how critical hole locations are handled—whether they are cut to size or intentionally finished after cutting. Finally, understand what the supplier inspects on first articles and which parameters are monitored throughout production.

These questions are buyer-friendly because they map directly to risk: assembly time, defect rate, and schedule stability.

What credible manufacturing guidance looks like in practice

In manufacturing content, credibility comes from practical reasoning rather than formal claims. Buyers tend to trust explanations that connect process choices to shop-floor consequences they already recognize—distortion, rework, edge preparation effort, tolerance stack-up, and batch-to-batch consistency.

When a supplier explains decisions in this cause-and-effect way, it signals real production experience. It shows that cutting is being evaluated not in isolation, but as part of a complete manufacturing system that must perform reliably over time.

Plate Cutting as a Foundation for Reliable Supply

Plate cutting sits at the front of the fabrication chain, and its influence compounds. For products such as frames, enclosures, racks, and structural components, cutting quality determines how smoothly parts move through production and how reliably batches repeat.

Treating plate cutting as a manufacturing decision—not a standalone service—helps wholesale buyers reduce variability, control cost, and protect delivery schedules. Clear expectations around edge condition, realistic tolerance strategies, and alignment with downstream processes create more stable outcomes.

At YISHANG, we work with overseas wholesale buyers who prioritize consistency alongside cost. If you are sourcing plate-cut components for repeat production and want to reduce downstream risk, send us your drawings and key requirements. We’ll respond with a practical manufacturing route and the quality checkpoints that protect your order.